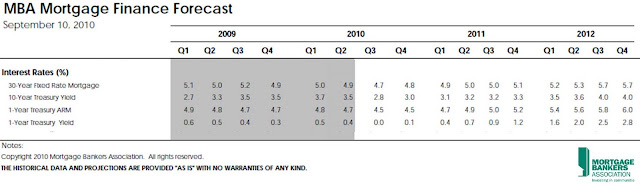

In a recent forecast of future market conditions, MBA economists published the following information about interest rates from 2009 to 2012. It has the average rates per quarter since the beginning of 2009 shadded in gray. The other numbers are the projected average interest rates per quarter.

As you can see it is expected that rates will increase to 5% by this time next year, and up to 5.7% by the end of 2012. This rise in interest rates will reduce buying power by as much as 10%!

Today with an $1,100 monthly payment you could probably get a $175,000 home. Next year that payment will only get you a $165,500 home, and by the end of 2012 the price of the home you can afford will be closer to $150,000. Here is a graphic demonstrating how the rates change buying power.

The primary reason for rising interest rates is increased deman for mortgages. This would also indicate an increase in demand for homes. As we all know, increased demand leads to increased prices. Consequently, it is possible that these increasing rates could cost even more.

Posted by Help Now on

Leave A Comment